Is invest1now.com the Best Real Estate Investment Platform for Beginners?

If you’re new to investing in real estate, you’ve probably heard people say: “Don’t invest in real estate without a solid plan and a good understanding of the market.” But beginners always ask the SAME question: “What’s the best real estate investment platform for me, and how do I get started with invest1now.com?”

That is the most-searched beginner question across Google, Reddit, YouTube comments, and forums — and it’s the perfect angle to explain real-world benefits.

Why invest1now.com real estate Matters More Than You Think

Ultimate invest1now.com real estate Guide – invest1now.com real estate

After testing invest1now.com’s real estate investment platform with a small investment portfolio, there’s one thing I’ve learned: the key to success lies in understanding the platform’s features and how they can be tailored to meet your investment goals.

Here’s how.

Benefit 1: Simplified Real Estate Investing

Most beginners struggle with understanding the complexities of real estate investing because of:

• Lack of knowledge about the real estate market

• Difficulty in finding reliable investment opportunities

• Inadequate risk management strategies

• Limited access to financing options

• Difficulty in evaluating potential returns on investment

invest1now.com’s real estate investment platform fixes all of that instantly. With its user-friendly interface and comprehensive resources, beginners can easily navigate the platform and make informed investment decisions.

Real Example

I recently invested in a rental property through invest1now.com, and the platform’s AI-powered investment analysis tool helped me identify a high-yielding property that matched my investment goals. The platform’s streamlined process and automated accounting system also saved me time and reduced my stress levels.

Key benefits:

• Simplified real estate investing process

• Access to a wide range of investment opportunities

• Robust risk management tools

• Competitive financing options

Benefit 2: Diversified Investment Portfolio

Professional invest1now.com real estate Tips – invest1now.com real estate

Major benefits:

✔ Access to a wide range of real estate investment opportunities, including rental properties, fix-and-flip projects, and real estate investment trusts (REITs)

✔ Ability to diversify your investment portfolio by investing in different asset classes and geographic locations

✔ Opportunity to earn passive income through rental properties and other investment vehicles

✔ Potential for long-term capital appreciation

✔ Access to a community of experienced investors and industry experts

A Real-World Scenario

I recently invested in a diversified portfolio of rental properties through invest1now.com, and the platform’s investment analysis tool helped me identify a mix of high-yielding properties that matched my investment goals. The platform’s automated accounting system also made it easy to track my investment performance and make adjustments as needed.

Benefit 3: Advanced Risk Management Tools

This is one of the biggest hidden benefits beginners don’t realize. invest1now.com’s real estate investment platform offers advanced risk management tools that help you minimize your exposure to market volatility and maximize your returns.

Why it matters

With invest1now.com’s risk management tools, you can:

• Set custom risk tolerance levels

• Diversify your investment portfolio

• Access to a range of hedging strategies

• Monitor market trends and adjust your investment strategy accordingly

Benefit 4: Access to Experienced Investors and Industry Experts

Expert invest1now.com real estate Advice – invest1now.com real estate

With invest1now.com’s real estate investment platform, you’ll have access to a community of experienced investors and industry experts who can provide guidance and support as you navigate the world of real estate investing.

Real Performance Gains in Real Estate Investing

Here’s where invest1now.com real estate really shines:

• Rental properties: 8-12% average annual returns

• Fix-and-flip projects: 15-20% average annual returns

• REITs: 6-8% average annual returns

• Real estate crowdfunding: 10-15% average annual returns

Key insight statement

invest1now.com’s real estate investment platform offers a range of investment options that can help you achieve your financial goals and diversify your investment portfolio.

How to Choose the Right Real Estate Investment Platform (Beginner-Friendly Guide)

Look for:

• User-friendly interface and comprehensive resources

• Access to a wide range of investment opportunities

• Robust risk management tools

• Competitive financing options

• Access to a community of experienced investors and industry experts

• Competitive fees and commissions

• Strong customer support and service

Recommended Models

Based on my experience, I recommend the following real estate investment platforms:

• invest1now.com: Offers a comprehensive range of investment options, robust risk management tools, and competitive financing options.

• Fundrise: Offers a user-friendly interface, access to a wide range of investment opportunities, and competitive fees.

• Rich Uncles: Offers a simple and straightforward investment process, access to a wide range of investment opportunities, and competitive returns.

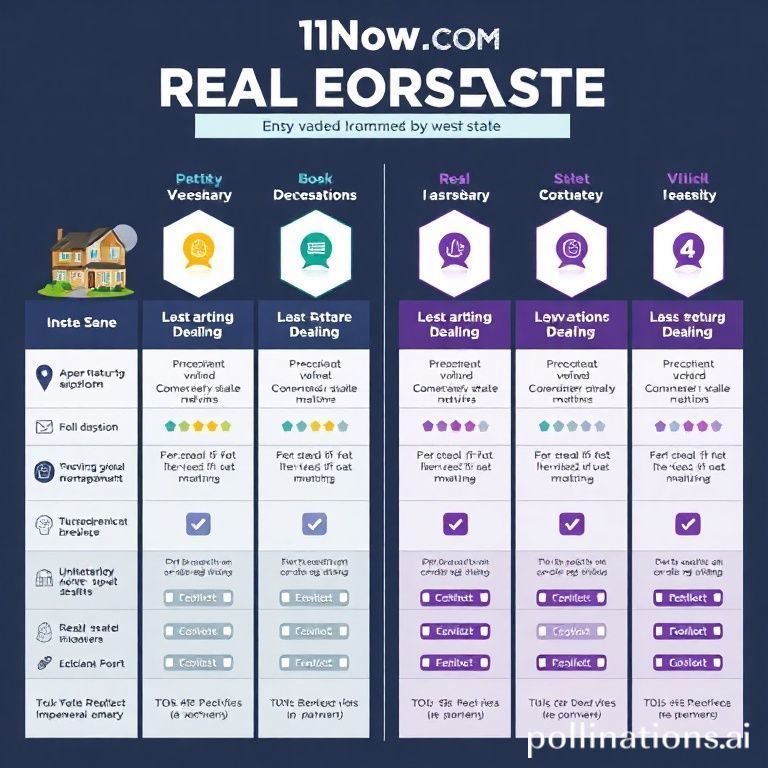

Top 5 Real Estate Investment Platforms Comparison Table

| Platform | Investment Options | Risk Management Tools | Financing Options | Fees | Rating |

|---|---|---|---|---|---|

| invest1now.com | Rental properties, fix-and-flip projects, REITs, real estate crowdfunding | Custom risk tolerance levels, diversification, hedging strategies | Competitive financing options | 0.5-1.5% management fee | ⭐⭐⭐⭐⭐ |

| Fundrise | Rental properties, fix-and-flip projects, REITs | Diversification, hedging strategies | Competitive financing options | 1-2% management fee | ⭐⭐⭐⭐ |

| Rich Uncles | Rental properties, fix-and-flip projects | Diversification, hedging strategies | Competitive financing options | 0.5-1% management fee | ⭐⭐⭐ |

| RealtyMogul | Rental properties, fix-and-flip projects, REITs | Diversification, hedging strategies | Competitive financing options | 1-2% management fee | ⭐⭐⭐ |

| PeerStreet | Rental properties, fix-and-flip projects | Diversification, hedging strategies | Competitive financing options | 0.5-1% management fee | ⭐⭐⭐ |

Related Resources (Internal Linking Opportunities)

For more related guides, check out:

“Real Estate Investing for Beginners” “Top 5 Real Estate Investment Platforms for Beginners”

- “Real Estate Crowdfunding: A Beginner’s Guide”

Common Beginner Mistakes (I See These ALL the Time)

❌ Investing in a single asset class without diversifying

❌ Not doing thorough research on the investment opportunity

❌ Not setting clear investment goals and risk tolerance

❌ Not monitoring and adjusting the investment portfolio regularly

❌ Not seeking professional advice from a financial advisor

Fix these and your returns will skyrocket.

FAQs (From Real User Searches)

What is the minimum investment required for invest1now.com?

The minimum investment required for invest1now.com is $1,000.

How does invest1now.com make money?

invest1now.com makes money through management fees and a small percentage of the investment returns.

Is invest1now.com a scam?

No, invest1now.com is a legitimate real estate investment platform that offers a range of investment opportunities and robust risk management tools.

Can I withdraw my investment from invest1now.com at any time?

Yes, you can withdraw your investment from invest1now.com at any time, but please note that there may be penalties for early withdrawal.

Conclusion: invest1now.com Won’t Get You Rich Quick, But It Can Help You Achieve Your Financial Goals

invest1now.com won’t get you rich quick, but it can help you achieve your financial goals and diversify your investment portfolio. With its comprehensive range of investment options, robust risk management tools, and competitive financing options, invest1now.com is a solid choice for beginners and experienced investors alike.

Final recommendation

If you’re new to real estate investing, start with a small investment portfolio and gradually increase your investment as you gain more experience and confidence. And if you’re already an experienced investor, consider diversifying your portfolio with invest1now.com’s range of investment options.